Nebraska offers residents and businesses clean energy incentives to install solar panels and invest in clean energy vehicles.

In combination with federal tax credits for green energy, the cost of any new equipment installed can qualify.**

TAX INCENTIVE NOTICE*

**Fraud Alert**

US Green Energy

Click Here to Sign Up for Free Solar Panel Installation

| Schedule | Acceptance Date | Last Day To Register |

|---|---|---|

| Q1 | Monday January 1, 2024 | March 30, 2024 |

| Q2 | Monday April 1, 2024 | June 30, 2024 |

| Q3 | Monday July 1, 2024 | September 30, 2024 |

| Q4 | Tuesday October 1, 2024 | December 30, 2024 |

| Q1 (2025) | Wednesday January 1, 2025 | March 30, 2025 |

PLEASE NOTE: Beginning in 2025, the federal tax incentives for solar residential installation will be impacted. See the table below for the dates and amounts currently legislated.

**The Federal tax credit is available every year that new equipment is installed.

Nebraska Government

Office of the Governor

Temporarily located at 1526 K Street

P.O. Box 94848

Lincoln, NE 68509-4848

Phone: (402) 471-2244

Fax: (402) 471-6031

Hours: M-F 8:00am – 5:00pm

Nebraska Public Power District

1414 15th Street

PO Box 499

Columbus, NE 68602-0499

(877) 275-6773

[email protected]

Hours: M-F 6:00am – 8:00pm

Saturday 8:00am – 12:00pm

Nebraska Department of Environment and Energy

245 Fallbrook Blvd, Suite 100

Lincoln, NE 68521

Phone: (402) 471-2186

Fax: (402) 471-2909

Toll Free: (877) 253-2603

[email protected]

Hours: M-F 8:00am – 5:00pm

Omaha/Valley Weather Bureau

6707 North 288th Street

Valley, NE 68064-9443

(402) 359-5166

[email protected]

Hours: Open Daily, 24 hours

Clean Energy and Vehicle Federal Tax Credits

Business Federal Tax Credits

State Tax Credit and Rebate Schedule

| Year | Credit Percentage | Availability |

|---|---|---|

| 2024-2032 | 30% | Individuals who install equipment during the tax year |

| 2033 | 26% | Individuals who install equipment during the tax year |

| 2034 | 22% | Individuals who install equipment during the tax year |

| 2008- | 100% Sales and use tax | Individuals who buy, lease, or rent a property to be used in a community-based energy development |

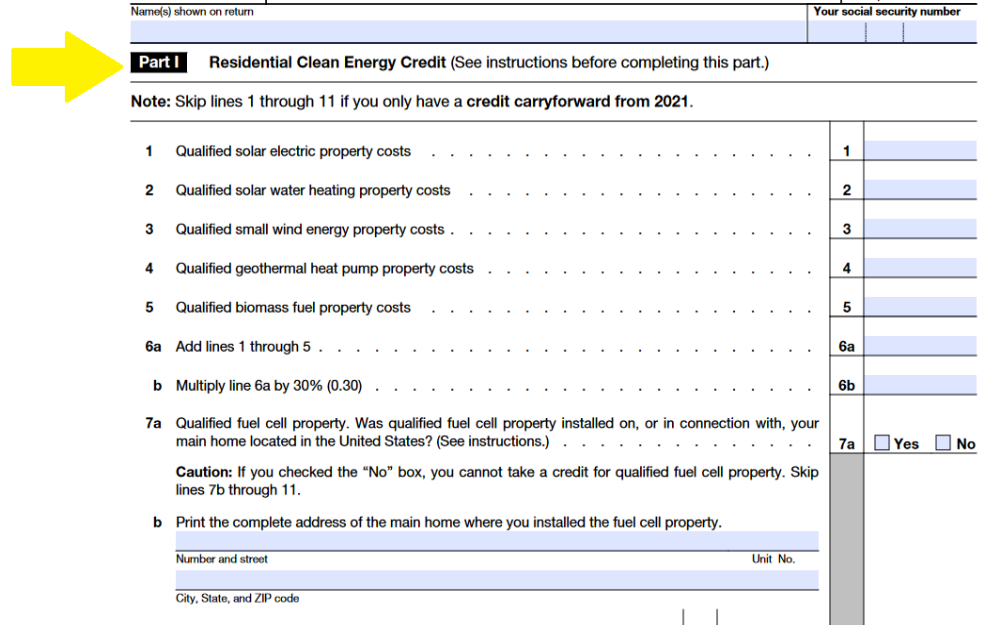

If you have determined that you are eligible for the green energy credit, complete Form 5695 and attach to your federal tax return (Form 1040 or Form 1040NR).

IRS Form 5695

Instructions

Future Due Dates and Basics

Office of Energy Efficiency & Renewable Energy

Forrestal Building

1000 Independence Avenue, SW

Washington, DC 20585

RESIDENTIAL CLEAN ENERGY TAX CREDIT

Nebraska Clean Energy

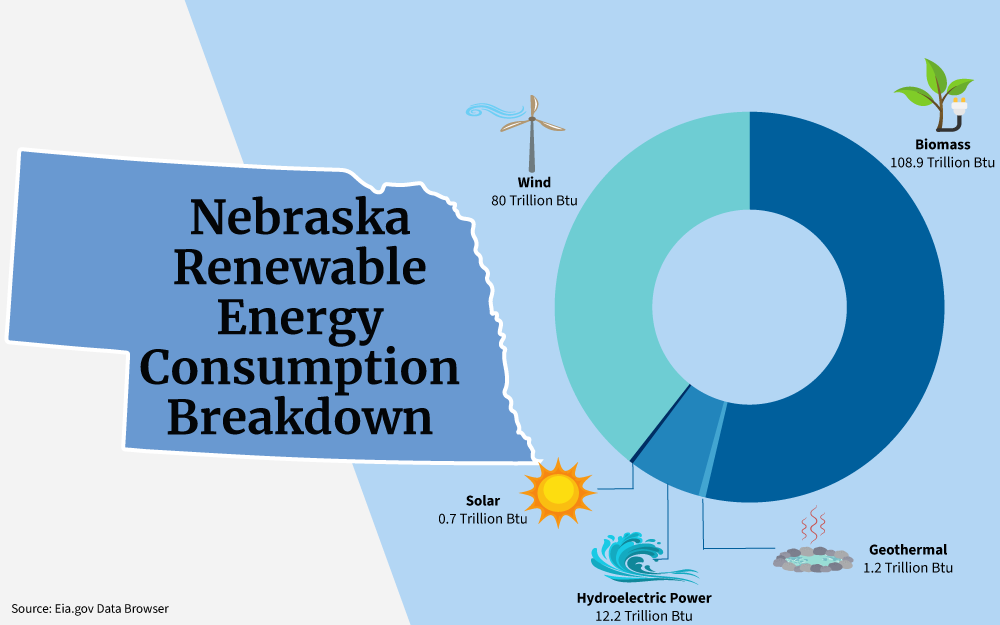

Renewable Energy Consumption

Solar Energy Generation

Wind Energy Generation

Biomass Energy Generation

Home Energy Ratings (HERS)

Nebraska (NEVI)

Email

Power Outage Map

Nebraska Department of Environment and Energy

Main: Lincoln Office

Phone: (402) 471-2186

Email: [email protected]

245 Fallbrook Blvd, Suite 100

Lincoln, NE 68521

Regional: Holdrege Office

Phone: (308) 991-1972 / (308) 991-1780

1308 2nd Street

Holdrege, NE 68949

Regional: North Platte Office

Phone: (308) 530-0874 / (308) 530-0875 / (308) 530-0873

200 South Silber

North Platte, NE 69101

Regional: Scottsbluff Office

Phone: (308) 641-7273 / (308) 765-9293

Scottsbluff State Office Building

505A Broadway

Scottsbluff, NE 69361-3515

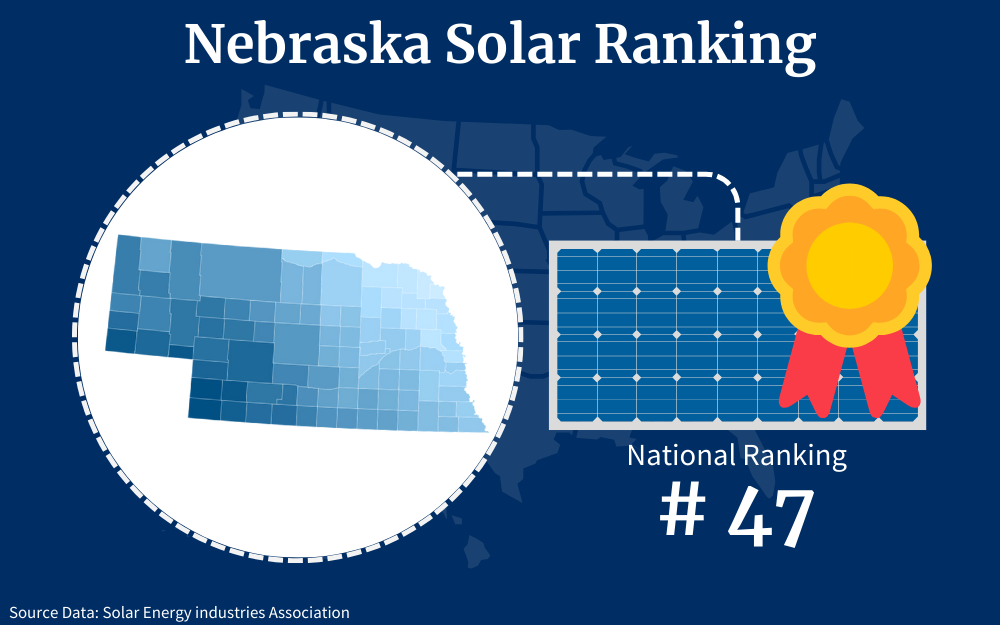

Nebraska solar incentives are designed to increase renewable energy use among homeowners, but many residents seem to be taking their time capitalizing on them.

The ‘Cornhusker State’ holds the 47th spot for installed solar capacity throughout the country,1 as only 30 percent of its electricity comes from solar energy.

Solar Panel Tax Credits Available in Nebraska

This guide outlines how you can enroll for Nebraska solar incentives including solar tax credits, financing, and rebates from renewable energy programs, all using online registration to make the process fast and simple.

Despite the relatively low ranking it has now, Nebraska is poised to make great progress, partly because the cost of solar panels has decreased by 54 percent over the last ten years.

These decreases, combined with the many state and federal incentives available for people interested in installing solar energy systems, create a promising future for the state.

In addition to the federal solar tax credit, the country also offers a variety of solar incentives for solar arrays by state and local jurisdiction. Nebraska is no exception.

Nebraska offers several solar tax credit options, many of which allow residents to decrease their taxable income (and, therefore, decrease the amount of money they owe in taxes for the previous year).

Applying for solar tax credits requires you to save all documentation related to your system and the installation process. For example, you’ll need to keep your receipts so you can calculate how much you spent and the amount of credit you’ll receive.

Federal Government Solar Incentives

The federal government offers a 30 percent credit for solar energy users called the Residential Clean Energy Credit.2 If you spent $10,000 on your solar units, you would qualify for a $3,333 credit.

To qualify for this credit, you must check some specific boxes, including these:

- Your system must be installed during the tax year for which you’re filing (the 30 percent credit applies to systems installed between 2022 and 2032)

- You own the system instead of leasing it

The credit also only applies to these expenses:

- PV or photovoltaic solar energy panels

- PV cells (such as those used to power attic fans)

- Contractor labor costs (including the cost of site preparation, panel assembly, panel installation, and fees for permits, inspections, and developers)

- Writing, inverters, mounting equipment, and other equipment required to balance the system

- Energy storage devices with a capacity rating of at least 3 kilowatt-hours (kWh)

- Sales taxes paid on any of these eligible expenses

Nebraska Solar Incentives for Residents

The Residential Clean Energy Credit is the primary incentive for Nebraska residents interested in installing photovoltaic panels.

However, Nebraska also offers a few state-specific solar power panel incentives and credits.

Some of the most well-known incentives homeowners might want to consider are described below:

Nebraska Dollar and Energy Savings Loans (DES)

Nebraskans who can’t afford to pay for their PV solar panels in full may want to consider the Nebraska Dollar and Energy Savings Loans program.3

How to enter this program:

- Check Eligibility: Review the program’s eligibility criteria to ensure you meet the requirements. Eligibility criteria can vary, but typically include factors like being a Nebraska resident, owning the property where the improvements will be made, and the type of improvements you plan to undertake.

- Energy Audit: Many energy-saving programs require an energy audit of your home to identify potential energy-saving improvements. Contact an energy auditor or a certified home energy assessor to conduct an assessment of your home’s energy efficiency.

They can help you identify areas where improvements are needed. - Select Eligible Improvements: Determine which energy-efficient improvements you want to make in your home. Common eligible improvements may include insulation, windows, heating and cooling systems, water heaters, and more.

Check the program’s guidelines to ensure your planned improvements qualify. - Find Participating Lenders: The program typically partners with local financial institutions to provide low-interest loans. Contact participating lenders to inquire about the DESL program and their loan terms.

- Complete the Loan Application: Fill out the loan application provided by the participating lender. You will likely need to provide information about your income, credit history, the proposed improvements, and the estimated cost of the project.

- Loan Approval: The lender will review your application and assess your creditworthiness. If approved, they will provide you with details about the loan terms, including the interest rate and repayment terms.

- Complete the Energy-Efficient Improvements: Once your loan is approved, you can proceed with the energy-efficient improvements on your property. Ensure that the work is done by qualified contractors who meet the program’s requirements.

- Submit Required Documentation: Be prepared to provide documentation and receipts related to the energy-efficient improvements as requested by the lender or the program administrator.

- Loan Disbursement: After the improvements are completed and the lender has verified the work, they will disburse the loan funds to cover the costs of the improvements.

- Repay the Loan: Repay the loan according to the agreed-upon terms with the lender.

Lending agencies throughout Nebraska disburse these loans to solar customers with interest rates of 5 percent or 3.5 percent. For some, including Nebraska Public Power District customers, the interest rates are even lower (around 1.5 percent).

This particular program states that the maximum loan term for solar panel systems is ten years, with a minimum payment of $50 per month. These loans are available for all solar customers, including the following:

- Homeowners

- Business owners

- Local governments

- Farm owners

Eligible loan amounts are based on these criteria:

- Systems up to 10 kilowatts: $14,000 for the first kW and $4,000 for each additional kW

- Systems larger than 10 kW: $19,000 for the first kW and $4,000 for each additional kW (up to 15 kW)

Based on these criteria, a 10 kW system would be eligible for a loan of $50,000 ($14,000 for the first kW and $36,000 for the additional 9 kW). Most systems in Nebraska are priced far lower than $50,000, so the loan would almost certainly cover the entire cost.

Nebraska Property Assessed Clean Energy (PACE) Financing

Seven years ago in 2016, Nebraska’s state legislature passed a bill officially titled The Property Assessed Clean Energy Act.18

This act is the closest the state gets to a low-income solar program. It gives municipalities the power to create programs that finance energy efficiency improvements on residential and commercial properties — including solar panel installation.

Programs created under the PACE Act strive to keep loan payments and interest rates as low as possible. They also roll loan repayment costs into property tax bills.

If you’re curious about PACE financing, remember that not all municipalities have implemented PACE programs. Here are some cities that currently offer PACE programs:

To take advantage of PACE financing, contact your municipality and find out if they offer a residential program. Then, fill out and submit an application for your municipality’s specific program.

From here, your municipality will get in touch to explain how to proceed.

Net Metering

Nebraska’s government legally requires net metering. Net metering allows electricity to travel between a home and the electric grid.

If the home’s panels produce more energy than it consumes, and the leftover energy gets sent to the electric grid, net metering provides the homeowner with a credit for the extra energy.

Residents can apply these credits to future electric bills. That way, even during times when solar production falls below energy consumption, they can still enjoy lower electric bills.

Lincoln Electric System Rebate

Lincoln Electric System — one of the state’s many electric providers — also offers virtual net metering.7

Virtual net metering allows customers to purchase “virtual” solar panels. They then get credits on their electric bills based on the number of virtual panels they’ve invested in, as well as the solar facility’s actual energy production.

Customers who have their systems installed by participants in Lincoln Electric System’s Solar Trade Ally Network can also qualify for a one-time capacity payment.8 This payment is based on the system’s size and the direction it faces.

What Is Needed To Qualify for Solar Credits?

The process of applying for solar credits is fairly straightforward. To benefit from the federal solar tax credit, you will first need to fill out Form 5695.19

Before you sit down to fill out the form, make sure you have essential details about your system. For example, you should know what equipment was installed, the size of the system, and its value.

If you don’t know the answers to any of these questions, you can reach out to the installer for assistance.

The total you calculated from Form 5695 will help you complete your taxes and ensure you get credited the correct amount.

Here’s a simple guide to completing Form 5695:

Step 1. Identify Eligible Expenses: Before you start filling out the form, gather all the relevant invoices and receipts related to your solar installation or other residential clean energy upgrades to determine your eligible expenses.

Step 2. Complete Part 1: In Part 1 of Form 5695, which is the “Residential Clean Energy Credit” section, enter the relevant amounts for your energy improvements. The form will guide you through calculating the credit amount for which you are eligible.

Step 3. Transfer to Form 1040: After you’ve completed Part 1, you’ll find a line that instructs you to transfer the credit amount to your Form 1040.20 This is usually entered on a specific line dedicated to tax credits on Form 1040.

Step 4. Attach to Tax Return: Once you’ve transferred the credit amount to your main tax return form (Form 1040), make sure to attach Form 5695 to it. Double-check all calculations and information to ensure accuracy before submitting.

If you’re still confused about how solar credits work and how they’ll benefit you, consider the answers to these common questions about Nebraska solar incentives:

- What happens if the tax credit is more than I owe, will I get a refund?

No. The Residential Clean Energy Credit is non-refundable,13 so you won’t get a refund if the credit exceeds what you owe. - What if I don’t own the house, can I take the tax credit?

No. You cannot claim a tax credit as a renter because the landlord technically owns the property and the solar panel system. - Can I qualify for the tax credit if someone else installed and used the PV system?

Maybe. Sometimes, a seller can transfer ownership of their solar panel system to the person buying their house.

If you were the buyer, that would mean you would qualify for tax credits or rebates associated with that system.

How Much Does It Cost for Solar Power Systems?

One of the most common solar panel facts people want to know is how much a system costs.

The price of your panels will vary based on several factors, including the following:

- Installation type (roof, carport, ground mount, etc.)

- Panel power density

- Panel color

- Number of panels installed

- Inverter type (string, micro, power, etc.)9

- Roof type (metal, shingle, flat, etc.)

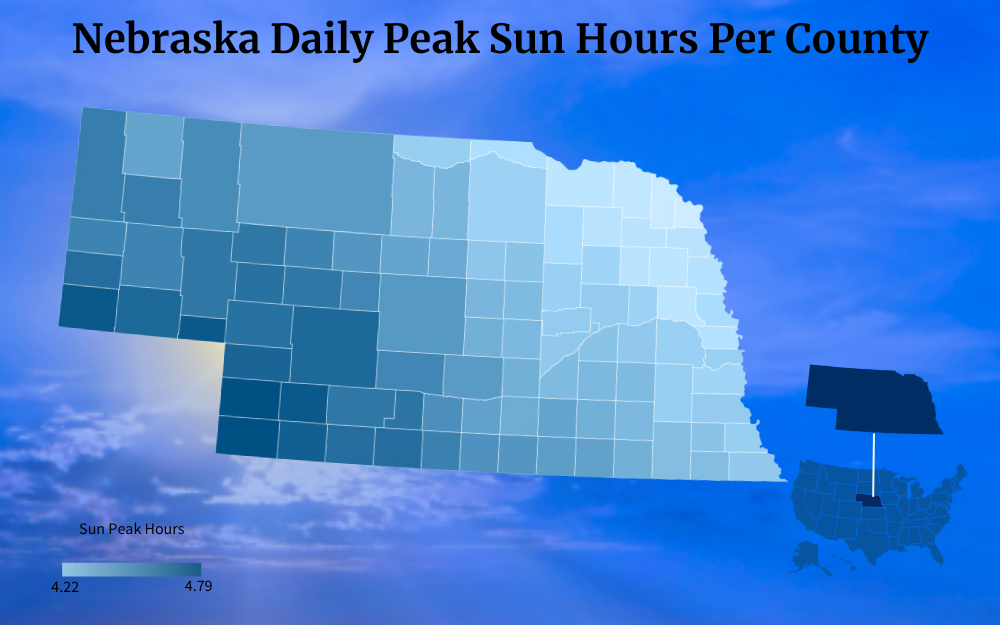

- Weather in your area (and the amount of sun you get)

- Amount of shading on your property

On average, Nebraska solar panels cost $2.83 per watt. If you had an 8 kW system, it would cost approximately $22,640.

You could also bring the price down by 30 percent (to $15,848) if you applied for the federal solar tax credit.

Leasing Solar Panels

Maybe you don’t have enough money lying around to pay for solar panels, and perhaps you don’t want to take out a loan. Another option is to lease the solar panels themselves.

The leasing option works virtually the same way it does when you rent anything else (a car, an apartment, etc.).

You make monthly payments for the panels, but you don’t own them (nor are you paying to own them one day).

Solar Power Purchase Agreements (SPPAs)

You can also make solar panels more affordable through a solar power purchase agreement (SPPA).10

If you enter an SPPA, you will make an agreement with a developer. The developer promises to handle the heavy lifting related to the solar panel system — its design, the permits, installation, financing, etc.

They then sell the power the system generates to you at a fixed rate.

Under this agreement, you get a lower, fixed electricity payment (and the knowledge that you’re doing something good for the environment). The developer earns money from selling power generated by the panels and benefits from solar-related tax incentives.

How To Calculate How Many Solar Panels You Need

The more panels you install (and, therefore, the more solar panels used), the more your system will cost.

To calculate the number of solar panels you’ll need to generate sufficient energy to power your home, you’ll need to know a few other important numbers:

- Annual electricity usage: This number, measured in kilowatt-hours or kWh, describes the amount of energy you use in a year and helps to determine the system size you need. The latest data shows that, in Nebraska, average electricity use was 10,515 kWh.11

- Solar panel wattage: Panel wattage, measured in watts or W, describes a panel’s electricity output under ideal conditions. On average, residential solar panels produce between 350 and 400 W of power.

- Production ratios: A production ratio compares a system’s estimated energy output over a period of time (measured in kWh) to the actual system size (measured in W). Most systems’ production ratios range from 1.3 to 1.6.

Now, it’s time for some math. The formula to calculate the number of panels you need is as follows:

- System size / Production ratio / Panel wattage = Number of panels required

Using the numbers mentioned above, the equation would look like this:

- 10,515 / 1.3 or 1.6 / 350 or 400 = 16.42 or 23.10

Rounding up (because you can’t get four-tenths or a tenth of a panel), you would need between 17 and 24 panels in your solar array.

How Can I Sell Power to Nebraska?

Net metering allows solar customers, both residential and commercial, to sell the electricity they don’t use back to the power company.

Like many other states in the nation, Nebraska’s state government requires all public utility companies to offer net metering.

However, there is no standardized credit rate for each kilowatt-hour sold.

Providers get to set their own rates, with some offering ones that fall below the retail price. Don’t let this information discourage you from participating in net metering programs, though.

Even if you get a below-retail-rate credit for the kilowatt hours you sell back to the power company, you’re still lowering your energy bill and using green energy.

If you need more convincing, consider the average cost of electricity in Nebraska. The average residential price per kilowatt hour is 10.91 cents.12

The average monthly electric bill is $111.68. A solar panel system could potentially eliminate your electric bill, or at least put a significant dent in the amount you pay each month.

Don’t forget about the long-term savings solar panels provide, either.

Over the life of solar panels (which last about 25-30 years), a system can provide energy savings of roughly $37,500. That’s more than enough for the system to pay for itself and deliver an impressive return on your investment.

How To Choose Solar Panels in Nebraska

You have several options to choose from as a Nebraskan who is interested in green power and considering solar panels.

The following are some of the most important factors to keep in mind when selecting a company to install your system:

Panel Type

Most Nebraska residents choose monocrystalline or polycrystalline solar panels for their homes.

Monocrystalline panels are the most efficient options, meaning they produce more kilowatt-hours for every square foot they cover. However, they are also the most expensive solar panel type.

Polycrystalline panels are more affordable and have the same lifespan as monocrystalline panels (both last at least 25 years). They’re not quite as efficient as monocrystalline panels, though, and they’re more likely to be affected by high temperatures.

Warranty Coverage

The average lifespan of solar panels is 30-35 years.14 Make sure the solar panel installer offers a warranty at least as long.

A warranty ensures that if part of your system breaks or malfunctions, you can get it fixed promptly without having to foot the (likely very expensive) bill.

Price

Your solar system’s price varies based on the size of your roof, the number of panels you need, etc. Get quotes from multiple solar panel installers before deciding which company you want to work with to ensure you get the best deal.

When comparing quotes, remember, that cheaper isn’t always better, especially when you’re dealing with solar panels. Consider the price, but don’t make it the end-all-be-all.

Payment Options

Maybe you don’t have tens of thousands of dollars set aside for a solar system. The good news is that you don’t have to.

Most solar panel providers offer a variety of payment options, including cash and financing programs. Remember that the state of Nebraska also offers loan programs (such as PACE financing and Dollar and Energy Savings Loans) so residents can experience the benefits of solar energy without draining their savings accounts.

Battery Storage Add-On Options

As a Nebraskan, you’re familiar with severe weather, from intense thunderstorms to tornadoes. You also know that, in these situations, it’s not uncommon for residents to lose power.

If you have a solar panel system with a solar battery storage system, you can preserve the extra energy you produce and use it during power outages.

A solar battery storage system does cost around $12,000-$22,000.15 However, it allows you to use more of your home’s solar energy.

It also reduces your reliance on local utility companies.

Installation Team’s Experience and Reputation

Choose a solar panel company with technicians who have plenty of previous installation experience.

Find out how long they’ve been in business and the kind of training technicians receive. They should be able to answer questions like “What is solar PV?” and “How do battery storage systems work” with ease as well.

Do your homework to see what past customers think (both positive and negative) about an installer or electrician for solar before you decide to hire them, too.

Are they generally satisfied with the service they received? Are they glad they chose that company to install their panels?

Take your time comparing providers and reading testimonials to ensure you’re making the best choice for your home (and your wallet).

Conversations around renewables like solar power have increased significantly over the last several years — including among Nebraskans. Worldwide, people are eager to save money on utilities and support the environment, and installing solar panels lets them do both.

For those who are concerned about the cost of solar panel systems and worry they can’t afford them, Nebraska solar incentives can help a great deal.

People in the Cornhusker State have many options that allow them to enjoy the benefits of solar panels without overspending, from the federal government’s Residential Clean Energy Credit to state and municipal programs that provide low-interest financing.

Use the guidelines shared here to determine your eligibility for Nebraska solar incentives.

Frequently Asked Questions About Nebraska Solar Incentives

Are Nebraska Residents Good Candidates for Solar Energy?

Yes, Nebraska has an average of 4.1-4.7 peak sun hours per day.16 Experts agree that an average of at least four hours of peak sunlight is best for those with solar panels who want to experience significant savings.

How Can I Participate in Lincoln Electric System’s Virtual Net Metering Program?

You can enroll on the LES website by purchasing one virtual half panel for $270 (or 36 monthly payments of $7.74)7 or a full panel for $540 or 36 monthly payments of $15.50.

How Did the Inflation Reduction Act of 2022 Influence Nebraska’s Solar Incentives?

The Inflation Reduction Act of 2022 extended the federal solar credit to 2032 years.17 It also increased the credit rate to 30 percent. Both of these changes benefit Nebraska residents and make it easier for them to invest in solar arrays.

References

1Solar Energy Industries Association. (2023). Nebraska Solar. Solar Energy Industries Association. Retrieved September 5, 2023, from <https://www.seia.org/state-solar-policy/nebraska-solar>

2Solar Energy Technologies Office. (2023, March). Homeowner’s Guide to the Federal Tax Credit for Solar Photovoltaics. Energy Efficiency & Renewable Energy. Retrieved September 5, 2023, from <https://www.energy.gov/eere/solar/homeowners-guide-federal-tax-credit-solar-photovoltaics>

3State of Nebraska. (2023). Dollar & Energy Saving Loans. Nebraska.gov. Retrieved September 5, 2023, from <https://neo.ne.gov/programs/loans/loans.html>

4Columbus, Nebraska Website. (2023). Property Assessed Clean Energy (PACE). Columbus, Nebraska Website. Retrieved September 5, 2023, from <https://columbusne.us/563/Property-Assessed-Clean-Energy-PACE>

5City of Norfolk. (2023). PACE Financing. City of Norfolk Website. Retrieved September 5, 2023, from <https://norfolkne.gov/government/departments/planning-and-development/pace-financing.html>

6City of Omaha Planning Department. (2023). PACE Program. City of Omaha Planning Department. Retrieved September 5, 2023, from <https://planninghcd.cityofomaha.org/pace>

7Lincoln Electric System. (2021). Enroll in LES virtual net metering. Lincoln Electric System. Retrieved September 5, 2023, from <https://www.les.com/solar-power/enroll-les-virtual-net-metering>

8Lincoln Electric System. (2021). Solar Trade Ally Network. Lincoln Electric System. Retrieved September 5, 2023, from <https://www.les.com/sustainability/solar-trade-ally-network>

9Solar Energy Technologies Office. (2023). Solar Integration: Inverters and Grid Services Basics. Energy Efficiency & Renewable Energy. Retrieved September 5, 2023, from <https://www.energy.gov/eere/solar/solar-integration-inverters-and-grid-services-basics>

10US Environmental Protection Agency. (2023, February 5). Solar Power Purchase Agreements. US Environmental Protection Agency. Retrieved September 5, 2023, from <https://www.epa.gov/green-power-markets/solar-power-purchase-agreements>

11Nebraska Department of Environment and Energy. (2023). Electricity Consumption in Nebraska by End–Use Sector. Nebraska Department of Environment and Energy. Retrieved September 5, 2023, from <https://neo.ne.gov/programs/stats/inf/48.html>

12Find Energy LLC. (2023, August 24). Electricity Rates in Nebraska. Find Energy. Retrieved September 5, 2023, from <https://findenergy.com/ne/>

13Internal Revenue Service. (2023, August 28). Residential Clean Energy Credit. Internal Revenue Service. Retrieved September 5, 2023, from <https://www.irs.gov/credits-deductions/residential-clean-energy-credit>

14Solar Energy Technologies Office. (2023). End-of-Life Management for Solar Photovoltaics. Energy Efficiency & Renewable Energy. Retrieved September 5, 2023, from <https://www.energy.gov/eere/solar/end-life-management-solar-photovoltaics>

15Solar Energy Technologies Office. (2021, November 22). Should I Get Battery Storage for My Solar Energy System? Energy Efficiency & Renewable Energy. Retrieved September 5, 2023, from <https://www.energy.gov/eere/solar/articles/should-i-get-battery-storage-my-solar-energy-system>

16Beale, A. (2022, September 21). Peak Sun Hours Calculator (with Map). Footprint Hero. Retrieved September 5, 2023, from <https://footprinthero.com/peak-sun-hours-calculator>

17The White House. (2023). The Inflation Reduction Act Delivers Affordable Clean Energy for Nebraska. The White House. Retrieved September 5, 2023, from <https://www.whitehouse.gov/wp-content/uploads/2022/08/Nebraska.pdf>

18US Department of Energy. (2023). Property Assessed Clean Energy Programs. Energy.gov. Retrieved September 14, 2023, from <https://www.energy.gov/scep/slsc/property-assessed-clean-energy-programs>

19Internal Revenue Service. (2023). Form 5695. IRS. Retrieved September 14, 2023, from <https://www.irs.gov/pub/irs-pdf/f5695.pdf>

20Internal Revenue Service. (2023). Form 1040. IRS. Retrieved September 14, 2023, from <https://www.irs.gov/pub/irs-pdf/f1040.pdf>

21Photo by Ken Oltmann/CoServ. Energy Efficiency & Renewable Energy. Retrieved from <https://www.energy.gov/eere/solar/solar-integration-inverters-and-grid-services-basics>